Go-To-Market in the AI Era

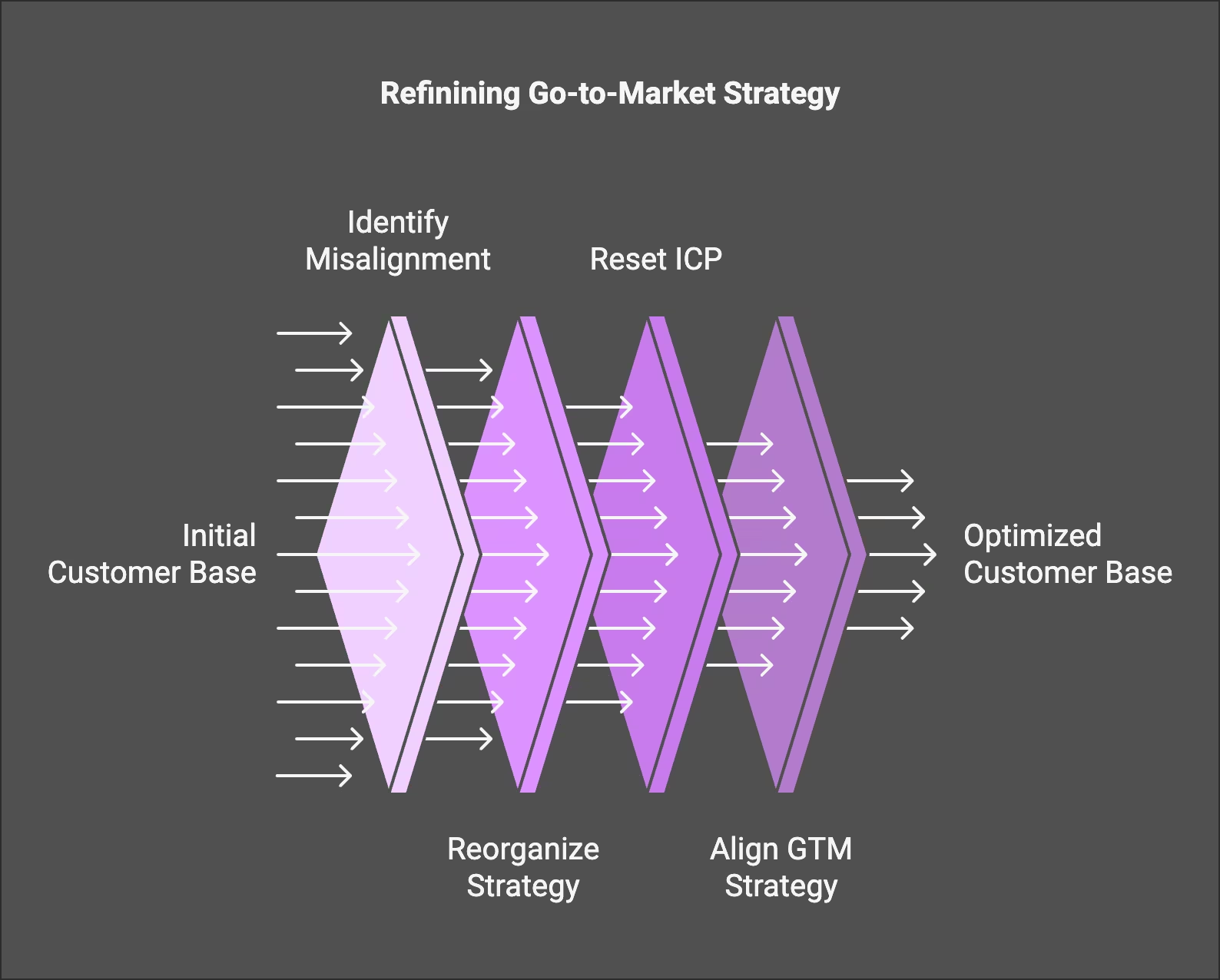

Go-to-market strategy has always been one of those areas where you feel the pain not when it’s missing—but when it’s wrong. I’ve lived through that. At CIENCE, we scaled fast, grew to 2,000 people across the globe, and hit #199 on the Inc. 500 list. But at one point, we realized something critical: we had the wrong customers. Not all of them, but too many. That misalignment—signing deals we shouldn’t have—created complexity, cost us margin, and nearly broke us.

It was a wake-up call. We reorganized, reset our ICP, and changed how we approached GTM entirely.

That’s what this piece is about: building a go-to-market strategy that’s aligned from the start, not one you have to unwind later. And doing it in a way that fits this new era we’re in—the AI era, where the old rules (and old stacks) don’t cut it anymore.

We call this GTM for the AI Era. Not because AI replaces sales, marketing, or RevOps. It does tedious elements of it, but you still need the spear that drives things forward. It augments it.

SDRs bring judgment, empathy, and creativity to outbound—but AI can handle the repetitive, time-sensitive tasks at scale. AEs are responsible for trust, negotiation, and deal strategy—tasks that do require a human. RevOps can focus less on duct-taping tools together and more on building repeatable systems and insights. For many companies some of these roles are going to be interchangeable, you will have more generalists that are able to move the needle across a well orchestrated platform. This is where everyone becomes an expert marketer!

This isn’t theory. At graph8, we built the company from the ground up as a compound startup—a full-stack GTM platform designed to empower everybody in the company to go to market like a pro. Not just the RevOps guy. Not just a giant SDR team. Everyone. Because what we saw over and over is that traditional GTM efforts involved a dozen people, a tangle of disconnected tools, and a constant uphill battle just to coordinate outreach.

So we went the other way. We built one integrated system where data, outreach, meetings, voice, and AI all work together. And most importantly, we designed it to enhance the human team, not replace them.

This blueprint outlines how B2B companies—especially mid-market or growth-stage ones—can rethink GTM from the ground up. Whether you’re launching a new product, entering a new segment, or realizing your current GTM just isn’t scaling well, these are the components that matter.

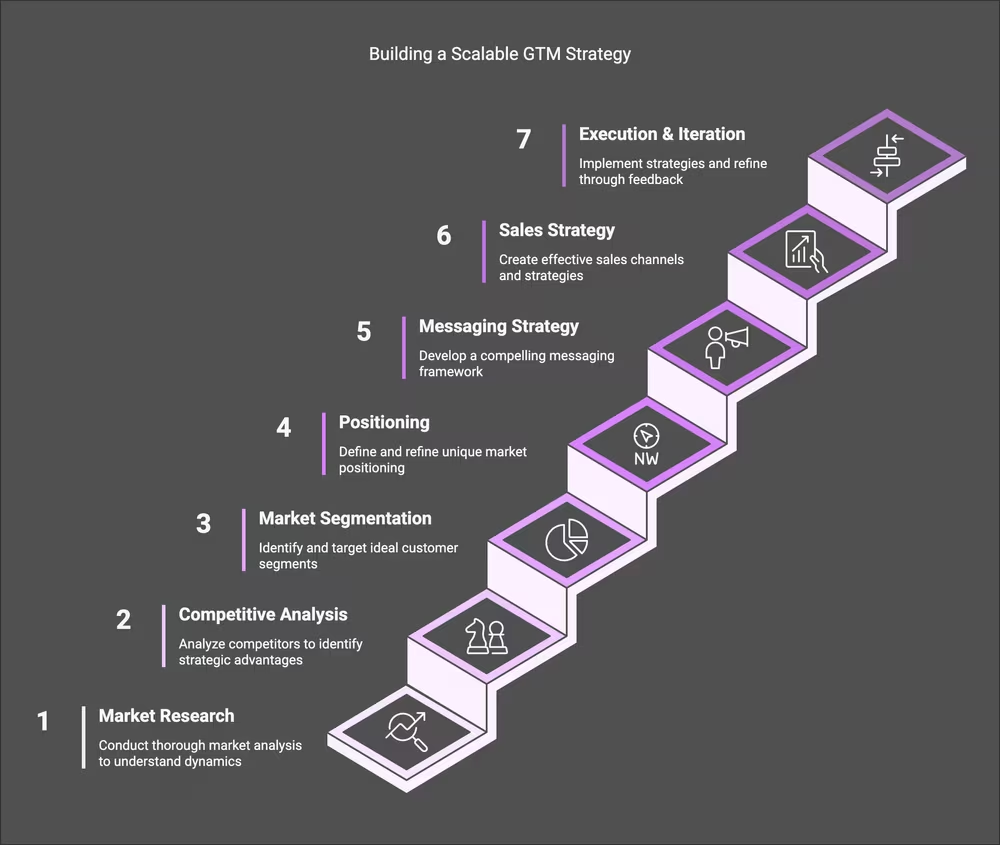

We’ll walk through each one—from market research and competitive analysis to segmentation, positioning, and beyond—explaining why each matters and how to execute them step by step. Throughout, we’ll blend proven strategic frameworks with pragmatic guidance, and show how AI, automation, and integrated GTM tools (like graph8) can operationalize these components at scale—while keeping humans at the heart of high-leverage work.

Market Research & Market Modeling: Foundation of GTM Planning

Every winning GTM strategy starts with deep market research. Market research means systematically gathering and analyzing information about your target customers, their needs and behaviors, and the overall market landscape.

Why Market Research Matters

Without solid market research, you’re flying blind. You might build a great product, but if you don’t understand who needs it, how they buy, or what they’re willing to pay, you’ll struggle to find product-market fit—let alone scale.

Market research answers fundamental questions:

- Who are your ideal customers?

- What problems do they face?

- How do they currently solve those problems?

- What are they willing to pay?

- How do they make buying decisions?

- Where do they spend their time (channels)?

- What trends are shaping their industry?

At graph8, we use our own data engine to analyze billions of data points—job changes, intent signals, company growth patterns—to build market models that inform our GTM strategy. This isn’t just about demographics; it’s about understanding buying behavior, intent, and timing.

Key Components of Market Research

1. Customer Interviews

Talk to your target customers. Not just happy ones—talk to prospects who didn’t buy, customers who churned, and people in adjacent markets. Ask open-ended questions:

- What’s your biggest challenge right now?

- How are you solving this today?

- What would make you switch?

- What’s your budget and approval process?

2. Competitive Analysis

Map your competitive landscape. Who else is solving this problem? How are they positioning? What are their strengths and weaknesses? Don’t just look at direct competitors—consider alternatives, substitutes, and “do nothing” as options.

3. Market Sizing

Estimate your Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM). This helps you understand the opportunity and set realistic targets.

4. Trend Analysis

What macro trends are affecting your market? Technology shifts, regulatory changes, economic factors? These shape buyer behavior and timing.

Market Modeling

Once you have research, build a market model. This is a framework that segments your market by characteristics that predict buying behavior—firmographics, technographics, intent signals, and behavioral data.

At graph8, we model markets by:

- Company size (revenue, employees)

- Industry vertical (with sub-segments)

- Technology stack (what tools they use)

- Growth stage (startup, growth, mature)

- Intent signals (research activity, job postings, funding)

This model becomes your targeting blueprint. It tells you who to go after, in what order, and with what message.

Segmentation and Targeting: Finding Your Sweet Spot

Not all customers are created equal. Segmentation is the process of dividing your market into distinct groups based on shared characteristics. Targeting is choosing which segments to pursue.

Why Segmentation Matters

Trying to be everything to everyone is a recipe for mediocrity. Segmentation lets you:

- Focus resources on high-value segments

- Tailor messaging and positioning

- Optimize pricing and packaging

- Build repeatable playbooks

How to Segment

Segment by characteristics that predict buying behavior:

Firmographic Segmentation:

- Company size (revenue, employees)

- Industry vertical

- Geography

- Growth stage

Behavioral Segmentation:

- Technology adoption (early adopters vs. laggards)

- Buying patterns (self-serve vs. enterprise)

- Engagement level (high-intent vs. browsing)

Intent-Based Segmentation:

- Research activity (what they’re searching for)

- Job changes (new decision-makers)

- Company events (funding, expansion, new initiatives)

At graph8, we use intent signals to segment accounts dynamically. An account moves from “awareness” to “consideration” to “decision” based on real-time behavior—not static lists.

Targeting Strategy

Once segmented, prioritize. Use a framework like:

- High value + High fit = Priority targets

- High value + Low fit = Custom approach

- Low value + High fit = Automated nurture

- Low value + Low fit = Deprioritize

Focus your outbound, sales, and marketing resources on priority targets. Use automation for lower-priority segments.

Competitive Analysis: Know Your Battlefield

You can’t win if you don’t know who you’re competing against—and how you’re different.

Why Competitive Analysis Matters

Competitive analysis helps you:

- Understand your positioning options

- Identify differentiation opportunities

- Anticipate competitor moves

- Refine your messaging

What to Analyze

1. Direct Competitors

Companies solving the same problem with similar solutions. Analyze:

- Their positioning and messaging

- Pricing and packaging

- Go-to-market channels

- Strengths and weaknesses

- Customer base and market share

2. Indirect Competitors

Companies solving adjacent problems or using different approaches. These matter because buyers might consider them.

3. Alternatives

“Build it ourselves,” “do nothing,” or “use spreadsheets.” These are often your biggest competition.

4. Substitutes

Different ways to solve the same problem. For example, if you sell CRM software, substitutes might include hiring more salespeople or using LinkedIn.

Competitive Positioning Framework

Use a framework like the Positioning Canvas to map where you fit:

- For (target customer)

- Who (has this need/problem)

- Our product (is a category)

- That (provides key benefit)

- Unlike (competitor)

- We (key differentiator)

Example: “For B2B sales teams who struggle with fragmented tools, graph8 is an integrated GTM platform that unifies data, outreach, and AI. Unlike point solutions, we provide one system where everything works together.”

Differentiation Strategy

Find your differentiation wedge. What can you own that competitors can’t easily copy?

- Technology moat: Proprietary data, AI, infrastructure

- Network effects: Platform that gets better with more users

- Brand: Thought leadership, category creation

- Go-to-market: Unique channels, partnerships, pricing

At graph8, our differentiation is the compound platform—data, apps, agents, and humans all integrated. Competitors might have pieces, but not the whole system.

Positioning: Own Your Category

Positioning is how you want to be perceived in the market. It’s not what you say—it’s what customers think when they hear your name.

Why Positioning Matters

Strong positioning:

- Makes you memorable

- Helps buyers understand your value quickly

- Justifies pricing

- Guides product and marketing decisions

Weak positioning means you’re competing on features and price—a race to the bottom.

Positioning Framework

April Dunford’s Positioning Canvas is gold. It forces you to answer:

- Target customer: Who specifically?

- Frame of reference: What category are you in?

- Point of difference: What makes you unique?

- Proof points: Why should they believe you?

Common Positioning Mistakes

1. Feature positioning: “We have X feature.” So what? What problem does that solve?

2. Generic positioning: “We’re the best CRM.” Everyone says that.

3. Competitor positioning: “We’re like X but better.” You’re defined by them, not you.

4. Category confusion: “We’re a CRM, marketing automation, and sales enablement platform.” Too many things = nothing.

Strong Positioning Examples

Slack: “Where work happens.” Owns team communication.

Salesforce: “The #1 CRM.” Owns CRM category.

graph8: “The compound GTM platform.” Owns integrated go-to-market.

The key? Own a concept. And back it up with product, story, and proof.

Messaging and Content Strategy: Bringing Positioning to Life

Once your positioning is clear, it’s time to translate that strategy into market-facing messaging that resonates. Messaging turns your internal clarity into external traction.

Why It Matters

The best positioning in the world doesn’t help if no one hears it—or worse, if it lands flat. Your messaging is what shapes perception in emails, on your site, in decks, in ads, and in conversations. It needs to be sharp, consistent, and tailored to your audience.

We build messaging frameworks at graph8 that distill our core value props, key differentiators, and proof points for different personas. Every outbound campaign, landing page, and chatbot script ties back to those.

Key Elements of a Messaging Framework

- One-liner: The elevator pitch. One sentence that makes people say “tell me more.”

- Core Value Pillars: Three to four high-level benefits you deliver.

- Proof Points: Quantitative or qualitative support—ROI stats, case studies, quotes.

- Persona-specific language: Tailor how each benefit gets framed depending on who you’re talking to (e.g., a CRO vs. a Marketing Ops lead).

- Voice and tone: Align with your brand personality—authoritative, playful, challenger, etc.

Example: Instead of saying “we provide omnichannel solutions,” we tested “Book meetings faster by combining voice, chat, and AI into one flow”—and saw a 2x reply rate. Clear always wins.

Content Strategy

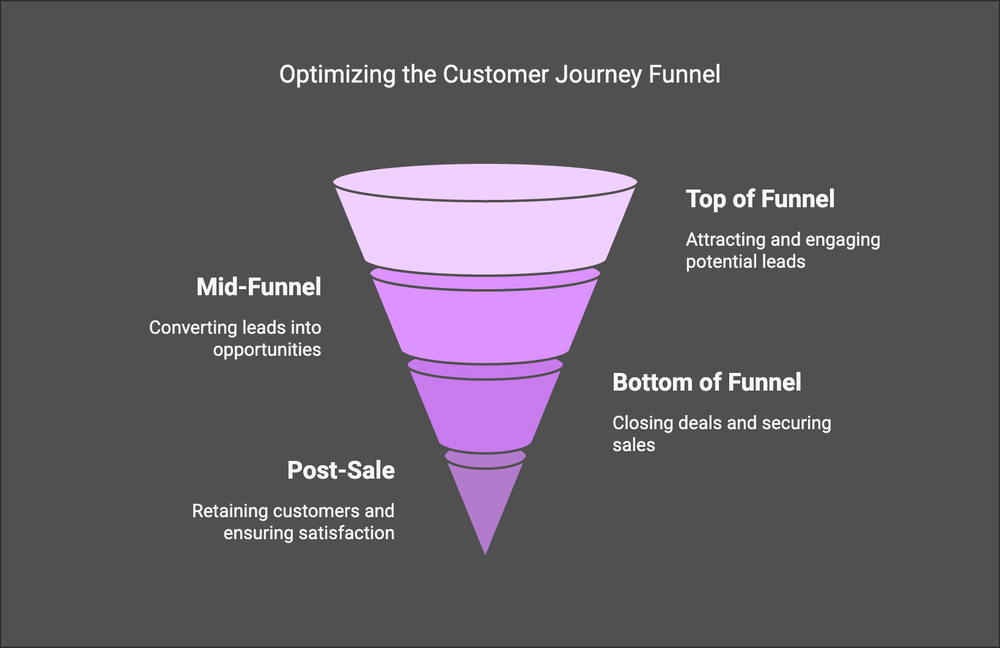

Messaging isn’t just for outbound. It fuels your content engine, which drives inbound. Your content should map to the buyer journey:

- Awareness: Blog posts, guides, LinkedIn posts.

- Consideration: Webinars, case studies, ROI tools.

- Decision: Demos, reviews, proof of value.

We layer intent signals at graph8 to prioritize which content to serve to whom, based on what they’re actively researching. It’s dynamic, not static.

Channels and Sales Strategy: Meeting the Customer Where They Are

With messaging locked in, you need to deliver it through the right channels—and with a sales motion that matches how your customers want to buy.

Choosing Channels

Ask: Where does your ICP spend time? What’s their buying behavior? Are they self-serve savvy? Do they need high-touch consultative support?

For graph8, we focused on:

- Outbound email (intent-informed, high personalization)

- AI voice and SMS (fast outreach, scalable follow-up)

- Inbound chat (to catch and qualify site visitors in real-time)

- Referral and partner channels (for credibility and niche access)

Sales Strategy

Sales models should evolve with product maturity and price point. Common options:

- PLG / Self-Serve: Great for bottom-up tools, especially if priced under $1K/mo.

- Inside Sales: For mid-size deals, fast sales cycles.

- Enterprise Sales: Long cycles, multiple stakeholders, requires a team.

graph8 uses a hybrid model. Our automation handles top-of-funnel. Human AEs and SEs jump in for high-intent, high-potential accounts.

Lesson learned: At CIENCE, we built large SDR teams manually qualifying leads. Now, with graph8, we automate much of that upfront work—so SDRs can focus on high value conversations.

Execution, Measurement, and Iteration: The Feedback Loop

This is where GTM plans live or die.

Cross-functional Execution

Product, marketing, sales, and CS need to work from the same GTM map. Weekly standups, shared dashboards, and a clear owner per stage make a huge difference.

At graph8, every campaign or product launch has:

- A defined ICP + intent segment

- A message tested in-market

- A feedback loop from sales and CS

Metrics That Matter

Pick a few metrics per GTM phase:

- Top of funnel: Lead volume, engagement rate, cost per MQL

- Mid-funnel: Conversion rate, time-to-opportunity, pipeline velocity

- Bottom of funnel: Win rate, deal cycle time, average ACV

- Post-sale: NRR, CSAT, upsell rate

We track these by segment and channel. That’s how we know what to double down on.

Iterate Fast

The biggest GTM mistake? Waiting too long to adapt. We test subject lines, swap copy, pause sequences, retarget new segments—all within days. AI tools like our own Campaign AI and Memory AI make this process continuous.

Example: One campaign underperformed. Memory AI flagged that messaging felt off-brand. We rewrote it, added specificity, and saw reply rates jump from 2% to 4%.

Closing Thoughts: Making GTM a Superpower

If you’re serious about scaling, GTM isn’t a function—it’s a flywheel.

The companies that win don’t just build great products. They design great go-to-market machines. Machines that:

- Know exactly who to target

- Say the right thing at the right time

- Meet buyers in the channels they use

- Learn and optimize automatically

That’s what we’re building with graph8. A compound platform to make GTM feel less like guesswork—and more like gravity.

Whether you use graph8 or not, the principles here hold. GTM in the AI era is about speed, specificity, and systems. The companies who embrace that will outlearn, out-execute, and outgrow the rest.

Let’s go build.

Further Reading & Thinkers to Follow:

- Kyle Poyar (PLG economics, monetization)

- Scott Leese (modern outbound strategy)

- Sangram Vajre (ABM and GTM orchestration)

- April Dunford (positioning)

- Lenny Rachitsky (growth loops and experimentation)

Related Posts

Navigating the Pricing Maze in the AI Era: Our Journey to Fixed Pricing at graph8

How we at graph8 grappled with pricing challenges in the AI era and why we ultimately decided on a fixed, all-inclusive pricing model.

2025 B2B Sales Automation Trends Report

The state of sales automation in 2025—what top teams automate, where AI agents fit, and which channels still outperform others in the modern GTM stack.

The Future of Sales: Integrating Voice AI into Your Marketing-Led Strategy

Explore how incorporating Voice AI into marketing-led strategies can revolutionize sales development, offering significant advantages in predictability, scalability, and consistency.